Resources for Homeowners

Many agencies and organizations have help available for homeowners to learn about the foreclosure process, understand their rights and responsibilities, and avoid scams and fraud.

This page gives additional resources and guidance. For individual help, reach out to a certified housing counselor who can explain all your options.

Find a Certified Housing Counselor

Oregon has a network of homeownership centers that offer counseling, education, and other resources.

Get StartedUnderstanding the Foreclosure Process

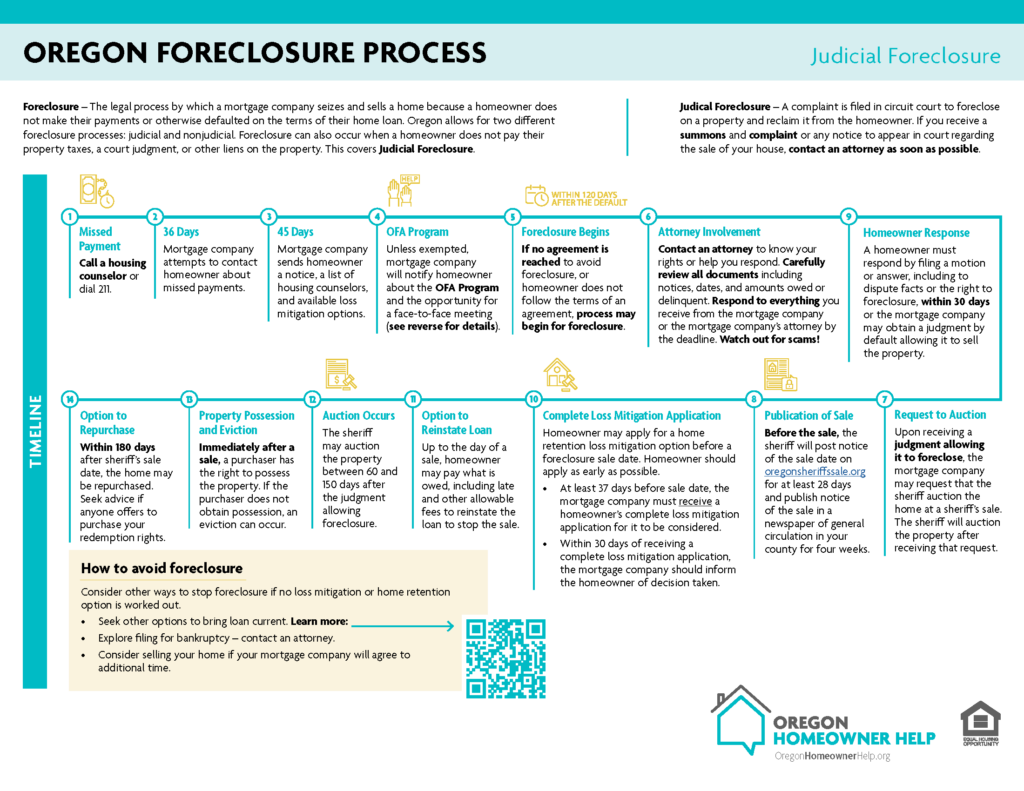

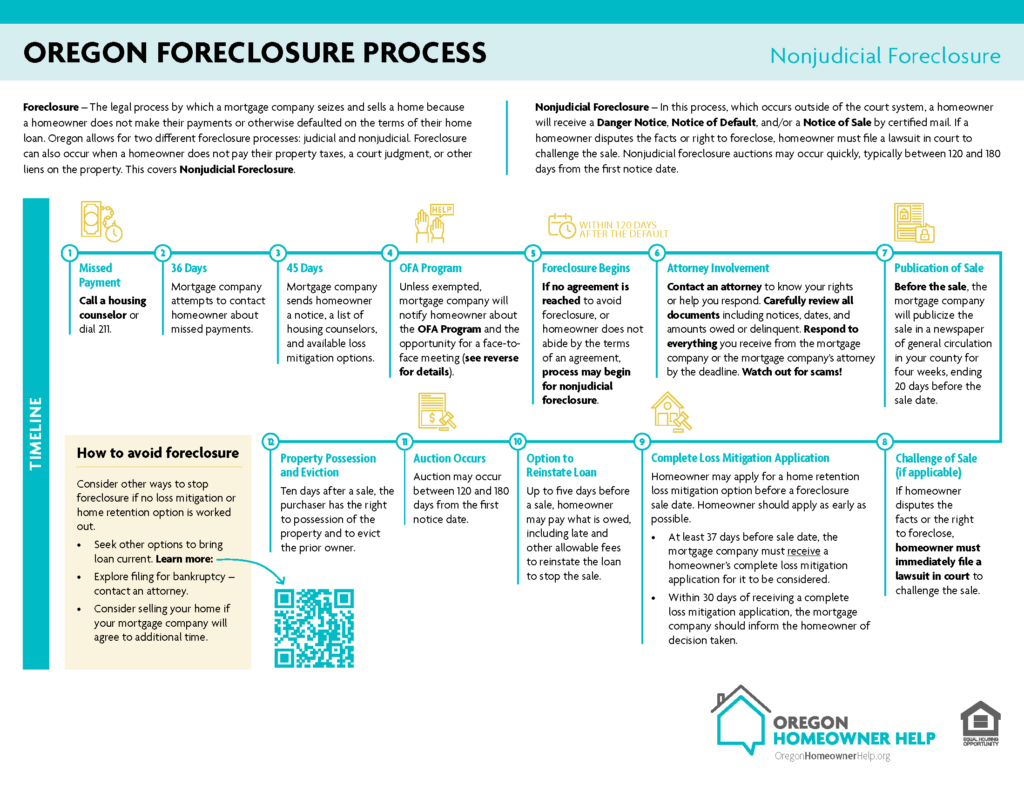

Foreclosure is the legal process by which a mortgage company seizes and sells a home because a homeowner does not make their payments or otherwise defaulted on the terms of their home loan. Foreclosure can also occur when a homeowner does not pay their property taxes, a court judgment, or other liens on the property.

There are two types of foreclosure processes in Oregon:

- Judicial foreclosure: A process of taking the house by filing a lawsuit against the homeowner. If you receive a Notice of Hearing or any notice to appear in court regarding the sale of your house, contact an attorney as soon as possible.

- Nonjudicial foreclosure: This process takes place outside of the court system. You will receive a Danger Notice, a Notice of Default and then a Notice of Trustee’s Sale or Trustee’s Notice of Sale by certified mail at least 120 days before the sale.

No matter what the type of foreclosure, help is available for homeowners. The sooner you reach out, the better. Find out what to expect through the foreclosure process with the following handouts:

Beware of Scams

If you are struggling with your mortgage, you may receive information by mail or telephone with promises of a quick-fix or easy solution to your mortgage problem. Scammers will even create letters or advertisements that look like they came from your mortgage company.

If you receive a call, text, email, or offer in the mail, call your mortgage company using the phone number on your mortgage statement, and ask if the communication came from the mortgage company.

How to Avoid Mortgage Scams

Be wary of anyone who promises to help negotiate with your lender to lower your home loan payments or save your house. Oregon law requires companies to be licensed and the license number must be displayed in all advertising.

Check a license or file a complaint online or call 888-877-4894 (toll-free). Oregon law also limits the fees someone can charge to perform debt management services.

The Oregon Division of Financial Regulation has a dedicated team of consumer advocates who are here to help, free of charge.

Signs of a Scam

Be aware when a counselor or company:

- Contacts you out of the blue, claims there is an emergency, or tells you to keep it secret

- Impersonates an official agency or a licensed attorney, with fake websites and toll-free numbers

- Tells you to avoid making payments, contacting your lender, or speaking to a nonprofit counselor

- Guarantees or promises positive results

- Asks for personal financial information, such as your bank accounts and Social Security number

Visit the Oregon Division of Financial Regulation’s foreclosure scams page to learn more.

Other Resources for Homeowners

Making Home Affordable

Visit www.makinghomeaffordable.gov for guidance and help from the federal government.

Scam Alert Network

This free service from the Oregon Department of Justice provides up-to-the-minute information about scams, frauds and other threats to consumers.

Videos

Oregon Housing and Community Services held Facebook Lives (in English and Spanish) on foreclosure prevention, forbearance options, preventing scams, and legal resources. Watch them all.

Keeping Your Home

This pamphlet from the Division of Financial Regulation is a go-to guide you can keep in your pocket.

Helpful links

The following federal government resources about managing finances before and during emergencies may be useful:

Tips to Stay Safe

Get it in Writing

Your home is an extremely important asset, so it’s okay to ask anyone you are working with to put a description of all services and promises in writing. Make sure you fully understand the documents before you sign them, or you could inadvertently sign away your home to someone else. Keep all of your records.

Don’t Pay Upfront

If a counselor demands you make a payment before receiving services, or will only accept payment via cash, automatic withdrawal, cashier’s check or wire transfer, be extremely suspicious. Make sure you know exactly what services you will receive before paying anything. Also, you don’t have to pay thousands – or even hundreds – of dollars for mortgage counseling as approved counselors provide their services at little or no charge.

Know Your Rights

Oregon law requires your lender to inform you about mortgage modification options and allow you to request good-faith negotiations which may help you avoid foreclosure.

Legal Help

If you need a lawyer, make sure the lawyer is licensed in Oregon. For help finding a lawyer or legal advice, contact:

Oregon State Bar’s Lawyer Referral Service » / 1-800-452-7636

Oregon Homeowner Legal Assistance (OHLA) Project » / 1-855-503-2598